2023 NHMA Legislative Bulletin 12

Primary tabs

LEGISLATIVE BULLETIN

Crossover is Near

It is almost time for “crossover”: the last day for the originating body to act on its own bills. Importantly, this week there was a report deadline for policy House bills so that those bills may be published in the House calendar for next week’s session. (The House has scheduled sessions on March 22, March 23, and April 6.)

The Senate has already dealt with many of its own bills and has started hearing bills sent over from the House; we anticipate that those hearings will continue through crossover.

For now, the focus is on the remaining bills that must be acted on by the full body. The House has well over 100 bills that must still see some kind of action, including many that are politically contentious. (The good news is that all our “big” bills have already been resolved—except for the budget, of course!)

Municipal Aid and the State Budget Webinar

On Monday, March 20 at 12:00 p.m., please join NHMA for a webinar about the various types of state revenue shared with municipalities, as well as critical state aid programs for public infrastructure improvements, including municipal drinking water and wastewater treatment facilities, highway maintenance, and bridge repair. As the state legislature begins debating its biennium budget for fiscal years 2024 and 2025 (HB 1) and the budget “trailer bill” (HB 2), towns and cities are preparing their budgets and waiting for anticipated revenue sharing and state aid in amounts yet unknown. Register here.

Municipal officials can also access NHMA’s updated publication State Aid to Municipalities: History and Trends to reflect the current budget and legislative decisions that have impacted municipalities.

Senate Saves Remote Attendance Bill

Those following the remote attendance bills this year know that the last surviving bill, SB 250, was recommended as Inexpedient to Legislate on a 3-2 vote out of the Senate Judiciary Committee. Although the prospects of allowing greater remote attendance for municipal boards looked dim, the Senate adopted a replace-all amendment, 2023-1040s, on a voice. The amendment was carefully crafted by one of the original bill’s cosponsors and addressed a number of concerns raised during the committee hearing. A subsequent voice vote passed the amended bill.

NHMA supported the original language of SB 250 and continues to support the amended SB 250. We are hopeful that the House will consider the carefully crafted language aimed at ensuring that the privilege of remote attendance is not abused. Importantly, the bill clarifies that:

In-person attendance at meetings is expected. Attendance of a member other than in person shall be not more than occasional and shall not be allowed for successive meetings by the chair without justification. Attendance in person is not reasonably practical when, in the opinion of the chair, the member is away from the location of the meeting for a legitimate reason, including but not limited to, work, medical reasons, weather conditions, or childcare. Except for a medical reason, a legitimate reason shall not include a member who is absent from the state or plans to be absent from the state for 28 or more consecutive days.

We believe that the language proposed by SB 250 carefully balances the interests of municipal boards in allowing members to occasionally attend meetings remotely with the need to ensure that government should be open, accessible, accountable and responsive.

Housing Champions Advances

Yesterday, the Senate passed SB 145, the housing champions bill, on a 21-3 vote. As the bill has a fiscal note, it must now go to Senate Finance, be considered by that committee, and again passed by the Senate before it can advance to the House.

As we wrote in Bulletin #2, the bill would provide municipalities access to new water, wastewater, and other infrastructure funding in exchange for voluntary changes to local zoning ordinances that promote the building of more housing. In total, SB 145 allocates $29 million to the Department of Business and Economic Affairs (BEA) to help tackle the housing shortage over the next two years: $1 million is allocated to a housing planning and regulation municipal grant program to assist municipalities in promoting increased housing production; $3 million is allocated for a housing production municipal grant program for municipalities which have seen the production of workforce housing units on a per-unit basis; and $25 million is allocated for a housing infrastructure municipal grant program for municipalities for new construction or capacity increases for drinking water, sanitary sewer, stormwater, highway infrastructure, telecommunications, and electrical distribution infrastructure.

The Senate Finance Committee has also considered SB 231, establishing a historic housing tax credit and making appropriations for workforce housing and affordable housing. SB 231 is similar to SB 145 in that it allocates a similar sum ($30 million) to BEA “for the purpose of improving the ability to accelerate the approval of affordable workforce housing.”

We are not yet sure whether the Senate intends on sending BEA $59 million to address the housing shortage or whether there will be further negotiations relative to the (approximately) $30 million that two separate bills plan on appropriating to BEA to achieve the same goals. As we stated in Bulletin #2, NHMA has a policy position to support legislation which promotes a collaborative approach between the state, municipalities, and other key stakeholders to address the state’s housing shortage.

We will continue to work with stakeholders as these bills make their way through the Senate—and the Senate begins to obtain information about state revenues and any potential surplus—and advocate for collaborative approaches that can serve as a national model on how to address the housing issue.

Committee Supports UAAL Paydown

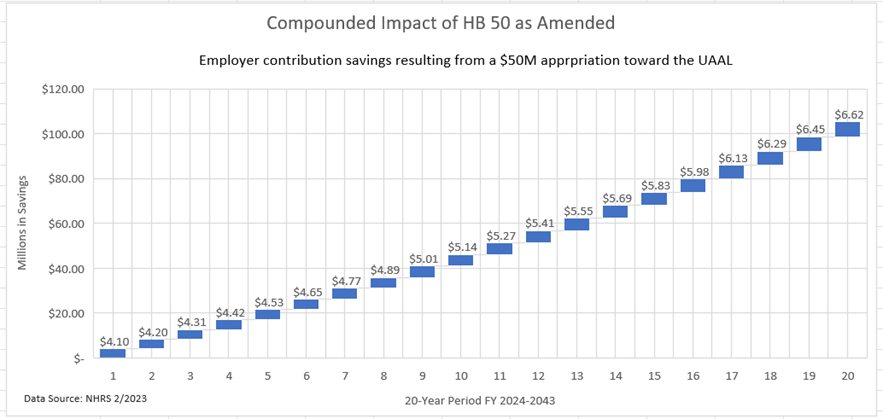

This week, the House Finance Committee recommended as Ought to Pass two significant bills that would positively affect the New Hampshire Retirement System (NHRS) and our members. HB 50, as amended, would appropriate $50 million in fiscal year 2024 for the purpose of reducing the retirement system’s unfunded actuarial accrued liability (UAAL) determined under RSA 100-A:16, II. The intent is to pay down the UAAL on a more aggressive schedule, resulting in lowered future employer contribution rates and promoting a financially sustainable defined benefit plan.

We have received preliminary data from NHRS which demonstrates the compounding impact of HB 50 as amended. Using the most recent 2021 actuarial data and applying $50 million to the UAAL in 2024, NHRS estimates that the impact of this legislation would have been a 0.13 percent reduction in the aggregate 2024-2025 employer rates. Over a 20-year period, a $50 million dollar payment applied in FY 2024 could have a compounded savings impact of $105 million as demonstrated in the graph below.

The committee also recommended as Ought to Pass HB 555, which would require that the state transfer 75 percent of the biennial surplus to NHRS to reduce the retirement system’s unfunded actuarial accrued liability (UAAL) determined under RSA 100-A:16, II to the extent the state’s surplus meets or exceeds certain financial conditions. This bill would implement a funding policy that aggressively pays down the unfunded liability to the benefit of the overall retirement system and provides a new level relief on employer contribution rates over the long term.

For fiscal year 2022, NHRS reported an unfunded liability of $5.69 billion in the actuarial valuation. Current actuarial valuations estimate that the unfunded liability accounts for more than 75 percent of current employer rates which is borne solely by the participating employers. NHMA supports legislation that promotes a solvent, fiscally healthy, and financially sustainable defined benefit plan that both employees and employers can rely on to provide retirement benefits for the foreseeable future.

Although reducing the UAAL will benefit all employers in the NHRS, it is important to remember that these projections do not account for other factors that may affect the UAAL—such as return on investments, changes in economic or demographic assumptions, and any new or expanded legislative changes to NHRS benefits. In fact, on that last point, and as we explained in last week’s Bulletin, several costly retirement-related bills will go to the House floor in the coming weeks. Please contact your representatives and ask them to support HB 50 and HB 555, enacting policy that promotes a secure, solvent, fiscally healthy, and financially sustainable retirement system benefits for the foreseeable future, and to oppose any new or expanded benefits that increase current or future employer contribution costs unless the state terminally funds them through the budget process.

The SAG-a Continues: State Aid Grants

During the past several state budget cycles, sufficient funding for State Aid Grants (SAG) for eligible and completed wastewater projects has not been included in the state budget, and this unfortunate trend has continued with this year’s HB 2. Instead, SB 230, HB 311, and governor’s budget request all proposed to fund the SAG program at similar funding levels, but from different funding sources.

This week, the House Finance Committee voted to retain HB 311, which would appropriate $15 million for each of the 2024 and 2025 fiscal years to fund the state share of eligible and completed wastewater projects under the SAG program. The recommendation was based on the governor’s budget, which calls for $27.9 million in state surplus to be used to fund wastewater state aid grants to municipalities. The Senate also tabled SB 230, which would appropriate $30 million in non-lapsing funds through the state budget process, leaving eligible SAG projects with uncertainty as to the funding source. Please continue to contact your senators and representatives to express the critical need for the state to fund this long-standing, statutory state-local partnership by including full funding in the state budget.

Town Meeting (Snow) Day

This past week, most New Hampshire towns were scheduled to hold their town meetings. But—in what is becoming its own sort of tradition—the state experienced another second-Tuesday-in March snowstorm, with some spots getting as much as 40 inches of snow. For those towns that went forward with their meetings, we hope all went well—flashlights and snowmobile rides included—and for those who postponed, we were pleased to see local officials working together to make these local decisions for their communities. As far as we’ve heard, the first significant use of SB 104 (Chapter Law 192:1, 2019), relative to postponing town elections and meetings, went smoothly this week. For those that didn’t visit the secretary of state’s website, the secretary posted the language of the statute on the homepage along with a list of towns that postponed. Those towns include:

Acworth, Alstead, Alton, Amherst, Andover, Antrim, Barrington, Bedford, Bennington, Bow, Bradford, Brookline, Charlestown, Chester, Chesterfield, Deerfield, Deering, Durham, Effingham, Farmington, Francestown, Gilford, Gilmanton, Goffstown, Grantham, Greenfield, Greenville, Hancock, Harrisville, Hart's Location, Hillsborough, Hollis, Hooksett, Hopkinton, Hudson, Jaffrey, Langdon, Lee, Lempster, Lyme, Lyndeborough, Madbury, Marlborough, Marlow, Mason, Milford, Milton, Mont Vernon, Nelson, New Boston, New Ipswich, New London, Newbury, Northwood, Nottingham, Raymond, Rindge, Salisbury, Sharon, South Hampton, Springfield, Sullivan, Sutton, Tamworth, Temple, Wakefield, Walpole, Warner, Washington, Westmoreland, Wilmot, Wilton, Winchester, and Windsor.

The good news is that, although power restoration is ongoing, the weather looks good for the foreseeable future, and we are hopeful that this year’s postponed town meetings will occur without further issue.

Hearing Schedule

Please click here to find a list of hearings next week on bills that NHMA is tracking. Please note that the linked PDF only covers hearings scheduled for the next week. For the most up-to-date information on when bills are scheduled for a hearing, please use our live bill tracker.

NHMA Upcoming Member Events

Mar. 20 | Webinar: Municipal Aid and the State Budget – 12:00 – 1:00 |

Mar. 29 | Webinar: Transportation Safety – 12:00 – 1:00 |

Mar. 30 | Webinar: How to Handle a First Amendment Audit – 12:00 – 1:00 |

Apr. 5 | Webinar: Succeeding at Tax Deeding – 12:00 – 1:00 |

Apr. 5 | 2023 Regional Legislative Update in Exeter – 6:30 p.m. |

Apr. 6 | Local Officials Workshop (hybrid) – 9:00 – 4:00 |

Apr. 19 | Right-to-Know Workshop (Public Meetings & Government Records) – 9:00 – 1:00 (Hybrid) |

Please visit www.nhmunicipal.org for the most up-to-date information regarding our upcoming events. Click on the Events& Training tab to view the calendar. For more information, please call NHMA’s Workshop registration line: (603) 230-3350. | |