2021 NHMA Legislative Bulletin 19

Primary tabs

LEGISLATIVE BULLETIN

Gunfire on Town Property

One of the last remaining aggressively anti-local government bills is HB 307, which is scheduled for a hearing on Monday, May 10 at 1:30 p.m., in the Senate Judiciary Committee. It is crucial that local officials oppose this bill.

The most important thing to know about HB 307 is that, while it calls itself “the New Hampshire Second Amendment state preemption act,” it has nothing to do with the Second Amendment. It is all about preventing municipalities from managing their own property.

Current law, RSA 159:26, completely preempts municipal regulation of the sale, ownership, possession, or transportation of firearms. Cities and towns have absolutely no authority over these matters, nor may they require licensing or permitting of firearms. They may not prohibit or limit the carrying of a firearm on public property. Nor may they regulate the use of firearms on private property. Thus, although HB 307 supporters claim the bill is necessary to protect gun owners’ rights, it is not. Those rights are already as safe from municipal regulation as they can possibly be.

The one thing municipalities may do under current law is to control what happens on their own property—just like any other property owner. RSA 41:11-a gives the governing body “authority to manage all real property owned by the town and to regulate its use, unless such management and regulation is delegated to other public officers by vote of the town.” This includes authority to regulate the discharge (but not the possession) of firearms on town-owned property.

HB 307 would change that. It states, in relevant part:

No public entity shall, and no private entity leasing or operating in any manner on any property owned . . . by the state [or] a political subdivision . . . shall regulate or attempt to regulate the sale, use, or possession of firearms . . . on any property owned . . . by the state [or a] political subdivision . . . unless explicitly authorized by statute.

Thus, a city or town could no longer prohibit, or regulate in any way, the discharge of firearms on its own property. It could not, for example, post its land against hunting or other uses of guns under RSA 635:4.

There is another statute, RSA 644:13, that would still provide some limits. That statute prohibits the discharge of a firearm “within the compact part of a town or city.” The statute’s definition of “compact part” arguably includes the area around town-owned buildings—although even that is unclear—and includes “any park, playground, or other outdoor public gathering place designated by the legislative body.” But it clearly does not include the following areas, which are not “public gathering places,” and HB 307 would not allow a municipality to prohibit shooting on these properties:

- A town cemetery;

- A town forest;

- A closed municipal landfill;

- Protected land around a municipal water source;

- Land held by the town for conservation purposes;

- Any other undeveloped town-owned land, including land taken by tax deed;

- A municipal parking lot more than 300 feet from the nearest commercial building (a separate state law, RSA 207:3-a, prohibiting hunting within 300 feet of a residential building does not apply to shooting for non-hunting purposes);

- Open areas at a municipally owned airport, such as the runways at Manchester-Boston Regional Airport.

No doubt there are many other examples.

Further, the prohibition in HB 307 applies to anyone “leasing or operating in any manner” on municipal property. Thus, if a town owns an agricultural field and leases it to a local farmer—an arrangement that exists in at least a few New Hampshire towns—the farmer could not post “No Hunting” signs on the land or restrict gunfire in any other way. (This would also apply to state-owned fields—see the following paragraph—that are leased to private individuals or businesses.)

Oddly, the bill as written even prohibits the state and counties from regulating the use of firearms on their own properties. We will not even try to imagine all the kinds of state-owned and county-owned properties where unlimited gunfire would now be permitted.

A town’s inability to regulate shooting on municipal property raises an obvious public safety concern, but that may not even be the biggest problem. At least a few towns have dealt with unauthorized shooting ranges on town property, and shooting ranges create a huge problem of lead contamination.

If lead on town-owned land gets into the groundwater, the town could face significant clean-up costs and other liabilities. The state should not prohibit towns from protecting their own properties against environmental contamination.

Finally, the bill also prohibits municipalities from regulating the use of “firearms accessories” on municipal property. These would include items like Tannerite, the reactive rifle target that produces an explosion, such as the recent one in Kingston that rocked several neighboring towns and was heard as far away as Massachusetts.

HB 307 is a dangerous bill that would seriously damage one of the most basic powers of a town or city—the power to control its own property. It does absolutely nothing to enhance Second Amendment rights; it merely requires local officials and residents to give up their rights to control local property. Please sign in opposition to HB 307 using the Senate remote sign-in sheet, contact members of the Judiciary Committee, and let us know if you have any questions.

Amendment Protects Municipal-Attorney Communications

The Senate Judiciary Committee will hold a hearing this coming Monday, May 10, on an extremely important amendment that affects the confidentiality of municipalities’ communications with their attorneys. We are asking local officials and their attorneys to sign in support of Amendment 2021-1251s to HB 108. The hearing is scheduled for 2:15 p.m. in the Senate Judiciary Committee.

Last month the New Hampshire Supreme Court issued a stunning decision in which it ruled that confidential communications between a governmental client (such as a city or town) and its legal counsel are not necessarily exempt from disclosure under the Right-to-Know Law. The court overruled its own precedents and held that rather than being per se exempt, attorney-client communications are subject to a “balancing test” that compares the public’s right to know against the government’s interest in non-disclosure and the importance of any privacy interest involved.

The consequences of this decision, if it is allowed to stand, will be devastating. As if local officials do not spend enough time responding to right-to-know requests, they will now be forced, upon request by any citizen, to apply a subjective balancing test to determine whether their own communications with their city or town legal counsel should be made public; and undoubtedly, some of those communications will be required to be disclosed. The chilling effect this will have on the attorney-client relationship is daunting.

The amendment mentioned above, introduced at NHMA’s request and with support from the attorney general’s office and many municipal attorneys, would overturn the court’s decision. It merely clarifies that “records protected under the attorney-client privilege or the attorney work product doctrine” are exempt from disclosure under the Right-to-Know Law, as they have been for over 50 years.

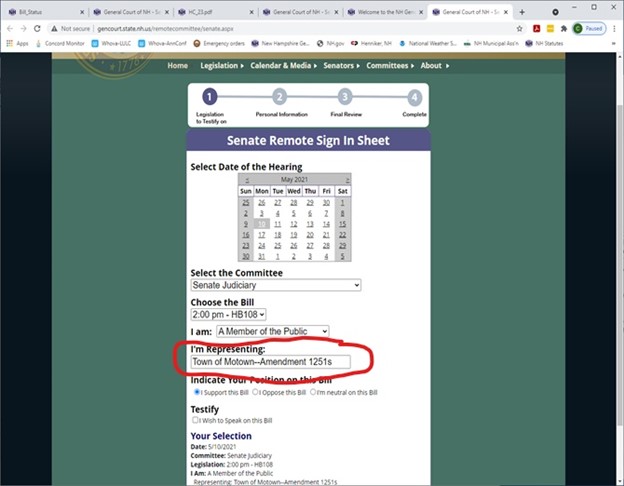

We are asking all local officials (and their municipal attorneys) to sign in support of this amendment. The process for this amendment is a bit complicated, so please follow these instructions precisely:

- Using the Senate remote sign-in sheet, go to May 10, then Senate Judiciary.

- There are two separate hearings for HB 108, one at 2:00 and one at 2:15. You are interested in the 2:15 hearing, but when you click on the 2:15 hearing, it will default to 2:00. That is a glitch in their system—don’t worry about it.

- In the “I am” box, select the appropriate answer. (If you are an appointed official, you will have to indicate “a member of the public.”)

- This is critical: In the “I’m representing” box, type in your municipality’s name, then “Amendment 1251s.” If you do not include “Amendment 1251s,” it will be unclear which amendment you are supporting.

- Click “I support this bill.”

- Do not check the “I wish to testify” box (we have several people lined up to speak).

- Continue to the next page, and submit the form.

See the example below.

Thank you! Please contact us if you have any questions.

Bills Seek to Boost Broadband

House committees will hear two bills on Monday, May 10, targeted at improving broadband in the state.

At 10:45 a.m., the House Municipal and County Government Committee will hold a hearing on SB 88, an omnibus bill relative to broadband. NHMA supports this important bill, which achieves three major broadband improvements: (1) streamlines the process for creating a communications district under RSA 53-G; (2) requires the New Hampshire Public Utilities Commission to adopt rules for implementing One Touch Make Ready as adopted by the Federal Communication Commission; and (3) ensures that municipalities receive necessary information in response to a request for information (RFI) when moving forward with broadband infrastructure bonds under RSA 33:3-g.

Also on Monday—at 10:50 a.m.—the House Finance Committee will hear SB 85, which establishes a dedicated broadband matching grant fund. This bill would authorize the Office of Strategic Initiatives (OSI) to award grants of up to 50% to eligible projects in an effort to increase statewide access to high-speed internet.

We know many municipalities have been working to improve broadband access, either on their own or as a joint effort with surrounding cities, towns, and counties. And now, since state and local governments are about to receive significant federal funds targeted for broadband infrastructure, the timing of SB 85 and SB 88 becomes even more important. We encourage municipal officials interested in this legislation to sign up to speak or sign in support of both bills.

Remote Meetings Bill Gains Support

On Tuesday the House Judiciary Committee heard testimony on SB 95 – the last surviving remote meetings bill. As we mentioned in last week's Bulletin, SB 95 enables public bodies to continue to meet remotely until July 1, 2022, as they have done under Emergency Order #12 during the pandemic. SB 95 also creates a legislative committee to examine remote meetings and make recommendations on the feasibility of continuing remote meetings.

We were deeply impressed with the show of support for the legislation. There were 102 individuals who signed in support and only 2 who signed in opposition, and all of the dozen-or-so people who spoke were in favor of the bill. Thank you to everyone who registered their support and/or spoke in support of the bill.

Every person who testified – including those who serve in the House or Senate – explained succinctly what our members have told us: remote meetings have made local government more accessible, and local governments are seeing significantly greater attendance now than pre-pandemic. Nonmunicipal entities, such as Granite State Independent Living and the Kent Street Coalition, also testified in support. They highlighted how the transition to remote meetings had allowed greater access and involvement of those, such as the elderly or disabled, who are dependent on others for transportation and care.

We are cautiously optimistic that this bipartisan bill will receive a favorable committee recommendation to the full House. Nevertheless, we encourage municipal officials to talk to their representatives about supporting SB 95.

Finance Committee Receives Many Hours of Budget Testimony

On Wednesday the Senate Finance Committee heard testimony on HB 1 and HB 2, the state budget and budget trailer bill, from a list of over 220 people who had signed up in advance of the two hearings held from 1:00 p.m. to approximately 9:30 p.m. NHMA submitted written testimony advocating for the restoration of state aid and revenue which was not included in the House version of the budget, as well as encouraging the state to use the federal funds to be received through the American Rescue Plan Funds Act (ARPA) in renewing its commitment to the state and local partnerships to fund critically needed infrastructure. The committee will hold budget work sessions at 1:00 p.m. on Monday, Tuesday and Friday next week on all state agencies and departments.

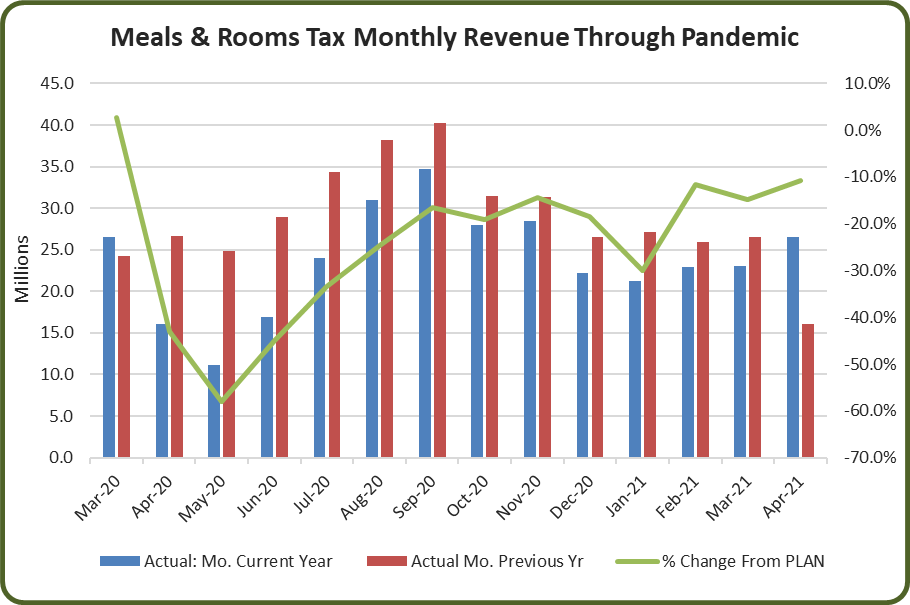

State Revenues Continue Upward Through April

The Monthly Revenue Focus issued by the state Department of Administrative Services on Wednesday reports unrestricted general and education funds received during April were above budget plan by $84.6 million (24.2%) and above prior year by $170.0 million (64.3%). This brings the total year-to-date unrestricted revenue above plan by $242.9 million (10.8%). While meals and rooms tax revenue still came in below plan—only missing the mark by $3.2 million (10.8%), the April revenues were above prior year by $10.4 million (64.6%). Year-to-date meals and rooms tax is now 19.8% below plan and only $35.5 million below the prior year-to-date revenue amount.

Senate Action on Municipal Bills

There was mostly good news from the Senate session this week. In brief:

Adoption of SB 2. The Senate killed HB 374, which would have required that the question of adopting the official ballot referendum (SB 2) form of town meeting be voted on by official ballot, rather than at the town meeting’s business session, as current law requires.

Petitioned warrant articles. The Senate also killed HB 67, which would have prohibited the amendment of a petitioned article in an SB 2 town to “change its specific intent.”

Electronic records and signatures. The Senate passed HB 302, which clarifies an ambiguity in the law and ensures that political subdivisions may use electronic records and signatures. The bill now goes to the governor for his signature.

Retirement costs. The Senate tabled HB 141, which would allow counties to exempt their chief administrative officers from compulsory participation in the state retirement system, as municipalities already may do. We wrote in last week’s Bulletin about our concern over an amendment that would require any county or municipality choosing this option to pay into the retirement system an annual employer contribution equal to the unfunded accrued liability rate for that “exempt” position. The bill may be taken off the table for further action next week. In the meantime, we plan to work with the New Hampshire Association of Counties in hopes of avoiding the problem created by the amendment.

Lemonade stands. The Senate passed HB 183, which, as amended, would exempt “persons under the age of 14 who are selling soft drinks on family owned or leased property” from licensing under the hawkers and peddlers statute. Although everyone agreed that this bill was unnecessary, the Senate version is a significant improvement over the House version. The bill now goes back to the House for a request to concur with the Senate amendment.

ARPA Funding for Cities and Towns

Like all our members, we are eagerly awaiting guidance from the U.S. Treasury on the direct funding to cities and towns from the American Rescue Plan Act (ARPA). The guidance is expected to come out any day now—but no later than May 11.

We know that the funds can be used for these purposes:

- Responding to the public health emergency with respect to COVID-19 or its negative economic impacts, including assistance to households, small businesses, and nonprofits, or aid to affected industries such as tourism, travel, and hospitality;

- Providing for government services to the extent of the reduction in revenue due to the public health emergency relative to revenues collected in the most recent full fiscal year;

- Making necessary investments in water, sewer, or broadband infrastructure; or

- Including premium pay for eligible workers performing essential work during the pandemic.

The Treasury guidance is expected to provide further explanation and answers to important questions about the use of these funds, including clarifying the purposes for which the funds can be used and explaining any requirements for documenting or reporting the use of the funds.

NHMA is also encouraging collaboration between state and local governments to maximize the deployment of these federal funds. There is a unique opportunity for significant investments in water and sewer and broadband infrastructure which will, in turn, attract new investment and return increased general fund revenues to the state.

In the meantime, the NHMA ARPA Information Page has extensive guidance and information on what we know so far, with materials from the National League of Cities (NLC) and the U.S Treasury websites. We will alert our members when the Treasury guidance is out, and we plan to host virtual informational sessions with NLC in the months to come.

House Calendar

All hearings will be held remotely. See the House calendar for links to join each hearing. | |

|

|

MONDAY, MAY 10, 2021 | |

|

|

FINANCE | |

10:50 a.m. | SB 85-FN, establishing a broadband matching grant initiative and fund. |

11:40 a.m. | SB 152-FN-A, relative to affordable housing program funding. |

|

|

MUNICIPAL AND COUNTY GOVERNMENT | |

9:00 a.m. | SB 84, relative to village district public bodies. |

9:45 a.m. | SB 86-FN, adopting omnibus legislation relative to planning and zoning. |

10:45 a.m. | SB 88, adopting omnibus legislation relative to broadband. |

|

|

TUESDAY, MAY 11, 2021 | |

|

|

JUDICIARY | |

9:00 a.m. | SB 96-FN-A, (New Title) relative to implicit bias training for judges; establishing a body-worn and in-car camera fund and making an appropriation therefor; amending juvenile delinquency proceedings and transfers to superior court; and establishing committees to study the role and scope of authority of school resource officers and the collection of race and ethnicity data on state identification cards. |

|

|

LEGISLATIVE ADMINISTRATION | |

9:00 a.m. | SB 100, adopting omnibus legislation on commissions and committees. |

10:00 a.m. | SB 142-FN, adopting omnibus legislation relative to certain study commissions. |

|

|

TRANSPORTATION | |

9:00 a.m. | SB 131-FN, adopting omnibus legislation relative to vehicles, municipal winter maintenance certificates, nondriver’s picture identification, and firefighter and emergency medical services decals |

|

|

MONDAY, MAY 17, 2021 | |

|

|

MUNICIPAL AND COUNTY GOVERNMENT | |

9:00 a.m. | SB 52, relative to municipal charter provisions for tax caps. |

9:45 a.m. | SB 87, adopting omnibus legislation relative to municipal finance. |

10:45 a.m. | SB 102, adopting omnibus legislation on property taxation. |

Senate Calendar

All hearings will be held remotely. See the Senate calendar for links to join each hearing. | |

|

|

MONDAY, MAY 10, 2021 | |

|

|

ELECTION LAW AND MUNICIPAL AFFAIRS | |

9:00 a.m. | HB 555, relative to prisoners’ voting rights. |

9:30 a.m. | HB 326, requiring town and city clerks to make electronic lists of persons who have requested, been mailed, or returned absentee ballots available to candidates upon request. |

9:45 a.m. | HB 292, relative to the absentee ballot application process. |

|

|

ENERGY AND NATURAL RESOURCES | |

1:00 p.m. | HB 177, prohibiting the siting of a landfill near a state park. |

|

|

JUDICIARY | |

1:30 p.m. | HB 307, relative to the state preemption of the regulation of firearms and ammunition. |

2:00 p.m. | Hearing on proposed Amendment #1144s, to HB 108-FN-LOCAL, relative to minutes and decisions in nonpublic sessions under the right-to-know law. |

2:15 p.m. | Hearing on proposed Amendment #1251s, relative to minutes and decisions in nonpublic sessions and making an exemption for items falling within the attorney-client privilege or the attorney work product doctrine under the right-to-know law., to HB 108-FN-LOCAL, relative to minutes and decisions in nonpublic sessions under the right-to-know law. |

|

|

TUESDAY, MAY 11, 2021 | |

|

|

JUDICIARY | |

1:15 p.m. | HB 566, relative to the discussion and disclosure of minutes from a nonpublic session under the right-to-know law. |

1:30 p.m. | HB 232, relative to nonpublic sessions under the right to know law. |

1:45 p.m. | HB 236, creating a statute of limitation on civil actions relative to damage caused by perfluoroalkyl and polyfluoroalkyl substances. |

Senate Floor Action

Thursday, May 6, 2021

HB 67-L, relative to warrant articles in official ballot town, school district, or village district meetings. Inexpedient to Legislate.

HB 141-FN, allowing a county to exempt its chief administrative officer from compulsory participation in the retirement system. Laid on Table.

HB 183, prohibiting municipalities from requiring a license for a soft drink stand operated by a person under the age of 18. Passed with Amendment.

HB 302, relative to the creation and use of electronic records by government agencies. Passed.

HB 332, relative to deadlines for consideration of developments of regional impact by planning boards. Passed.

HB 374, relative to the official ballot referendum form of town meetings. Inexpedient to Legislate.

HB 411, establishing a commission to study the equalization rate used for the calculation of a property tax abatement by the New Hampshire board of tax and land appeals, the superior court, and all cities, towns, and counties. Passed with Amendment.

HB 413, establishing a solid waste working group on solid waste management planning and relative to compost. Passed with Amendment.

HB 545, relative to the use of certain out-of-state banks by the state treasurer and municipal and county treasurers or trustees. Passed.

NHMA Upcoming Member Events

May 19 | Webinar: Intersect: New Traffic Technology (12:00 – 1:00) |

May 20 | Code Enforcement (9:00 – 12:00) |

June 10 | Municipal Trustee Introduction (9:00 – 3:00) |

Please visit www.nhmunicipal.org for the most up-to-date information regarding our upcoming virtual events. Click on the Events and Training tab to view the calendar. For more information, please call NHMA’s Workshop registration line: (603) 230-3350. | |