2021 NHMA Legislative Bulletin 18

Primary tabs

LEGISLATIVE BULLETIN

Tuesday Hearing on Remote Meetings Bill

As we mentioned last week, the House Judiciary Committee has scheduled its hearing on SB 95, which enables public bodies to continue to meet remotely as they have done under Emergency Order #12 during the pandemic. The hearing is scheduled for this coming Tuesday, May 4, at 9:00 a.m.

We have heard from many local officials about how well remote meetings have worked, and we have heard almost no complaints. Those benefiting the most seem to be not the board members themselves, but members of the public who are able to attend and (if permitted) participate in meetings from their own homes or elsewhere. We do expect that most local boards will return to in-person meetings once it is safe to do so, but it certainly would be helpful to have the remote meeting option when circumstances warrant it—not only during a statewide emergency.

The House Judiciary committee has been skeptical of remote meetings thus far. Earlier this year the committee reported one remote meetings bill, HB 216, as Inexpedient to Legislate (by an 11-10 vote). With a separate bill, HB 630, the committee voted 20-1 to remove the provisions for remote meetings, leaving only an unrelated statutory change in the bill.

We hope SB 95 will be viewed more favorably. In the interest of caution, the Senate included a sunset date of July 1, 2022, in the bill, essentially establishing a “probationary period” for remote meetings. After that date, the remote meeting option would disappear unless the legislature reauthorizes it. In the meantime, the bill creates a legislative committee to study remote meetings and make recommendations to the legislature. We think this is a prudent approach.

Local officials who would like to continue to have the remote meeting option are strongly encouraged to register in support of SB 95 using the House remote testimony form, or sign up to testify at the hearing on Tuesday. Please let us know if you have questions about the sign-up process.

Senate Finance to Hear Public Input on Budget

The Senate Finance Committee will hold two public hearings on the state budget on Tuesday, May 4, at 1:00 p.m. and 6:00 p.m. Members are encouraged to provide testimony about how the budget and the potential for additional (or reduced) state aid and revenue sharing could affect your town or city.

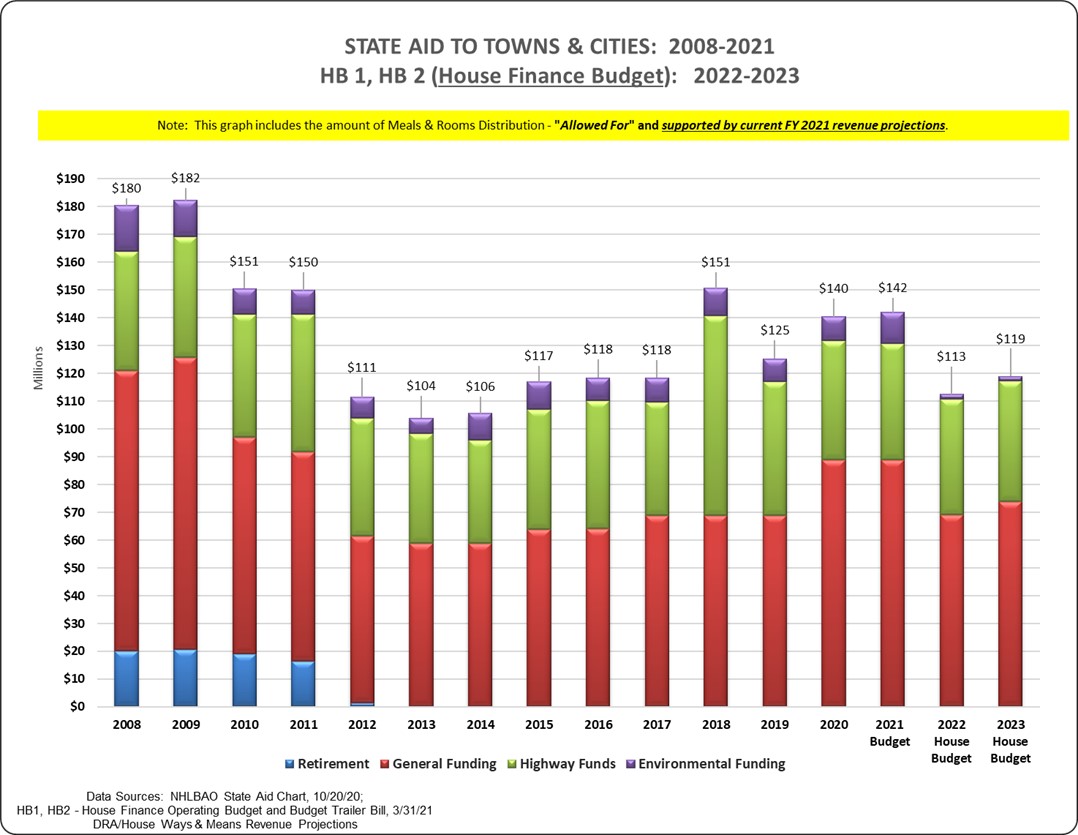

Under the House-approved budget, municipal aid and revenue sharing are currently projected to be $50.1 million* less than the current biennium (see chart below). *Note: Meals and rooms tax distributions would be $10 million less than what is “allowed for” in the operating budget based on the current fiscal year 2021 meals and rooms tax revenue projection that is less than the fiscal year 2020 revenue. The following is where things stand right now in terms of funding for cities and towns:

- Meals and Rooms Tax: $68.8 million and $73.8 million for fiscal years 2022 and 2023, respectively. For the first time since 2017, the statutory catch-up formula is not suspended in HB 2, thereby allowing (contingent on sufficient increases in year-over-year revenue) for up to $15 million in additional distributions ($5 million in FY 2022; $10 million in FY 2023), as appropriated in HB 1. Unfortunately, based on fiscal year 2021 meals and rooms tax revenue projections, the total biennium increase would be $5 million in fiscal year 2023 only.

- Revenue Sharing: $0 each year. Budget writers once again suspended RSA 31-A in HB 2, continuing an 11+ year pattern to defund the statutory $25.2 million per year revenue sharing.

- Highway Block Grant: $35.7 million and $37.2 million for fiscal years 2022 and 2023, respectively, for highway block grants. In addition to the statutory 12 percent municipal share from highway fund revenue, the House appropriated $4 million from general funds to ensure that the total block grant amount is approximately equal to the current biennium amount.

- Municipal Bridge Aid: $6.0 million each year for grants, $800,000 each year for “consultants.” Municipal bridge aid was budgeted a little differently this year. The line item for the annual grant amount was reduced from $6.8 million to $6.0 million; the remaining $1.6 million ($800,000 per year) is now included in a separate budget line item for “consultants.” We have learned from the Department of Transportation that it will be providing a new opportunity for some of the smaller towns to contract directly with DOT for bridge design, engineering, and consultant-type expenses, but that the total bridge aid amount will not be reduced—municipalities will still receive the full $6.8 million, which is the state’s statutory 80% share.

There are 113 enrolled municipal bridge projects through 2028—which include 66 of the current 223 “red list” bridges (2020 Red List Report issued 3/22/21). Enrollment is currently frozen with a waiting list.

- State Aid Grants (SAG): $0 each year for existing state aid grant (SAG) payments previously awarded and approved by the governor and executive council. HB 2 defunds 160 water pollution control projects in 56 political subdivisions—a reduction of $15.6 million from the governor’s budget. As we reported in Bulletin #12, HB 2 states that if unrestricted general fund revenues are above the budgeted plan on December 31, 2021, the commissioner of the Department of Environmental Services, “may,” with the approval of the legislative fiscal committee and the governor and executive council, request up to 50 percent of those funds to make grant payments. However, it does not provide any priority about which projects might receive payment.

- State Aid Grants: $0 each year for new state aid grants for substantially completed, eligible water pollution control, water supply, and landfill closure projects. There are currently 11 water pollution control projects that were slated for funding in the current biennium but placed on hold due to the pandemic, and there are 110 additional projects identified by the Department of Environmental Services as eligible in the next biennium. HB 2 places a moratorium on all eligible state aid grant projects under RSAs 486, 486-A, and 149-M.

- Flood Control: $887,000 each year for reimbursements to municipalities involved in interstate flood control compacts.

There are also four revenue-related bills for municipalities on the Senate table which can now be considered for inclusion in the state budget. These bills are discussed in detail in the article below.

The House budget makes a one-time $100 million reduction in the Statewide Education Property Tax (SWEPT) for fiscal year 2023. This would reduce the state education portion of the total property tax by approximately 28% for all taxpayers in fiscal year 2023 only. HB 2 also provides that those municipalities whose education grants are decreased due to the SWEPT reduction will receive a separate supplemental educational payment from the state.

Municipal officials are strongly encouraged to testify at the remote public hearings, or submit written testimony addressing concerns and needs specific to your municipality. As always, please let NHMA know of any testimony you plan to offer, and let us know if you have any questions about how to sign up or testify.

Senate Table Offers Additional Municipal Revenue Choices

As we have reported, there are four very important bills regarding municipal aid and revenue sharing that were laid on the Senate table last month. These bills can now be considered for inclusion in the state budget. We encourage municipal officials to include the important local benefits of these bills in your budget testimony (see above) to the Senate Finance Committee. The bills are:

- SB 99 returns the municipal share of meals and rooms tax to 40 percent, as reported by this New Hampshire Senate News Release. Although state revenue from the tax has increased 67 percent in the past 10 years ($204 million to $340 million), the amount distributed to municipalities has increased only 17 percent ($58.8 million to $68.8 million). To calculate the impact of SB 99 on your municipality, you can download this NHMA calculation tool.

- SB 118, the “property tax relief act of 2021,” would distribute $20 million in municipal aid for each of fiscal years 2022 and 2023, requiring 60 percent to be used for property tax rate reduction.

- SB 127, Parts VII and VIII, lifts the moratorium and provides funding for state aid grants (SAGs) for new eligible public water system projects ($1 million) and new eligible wastewater projects ($12.6 million) in fiscal years 2022 and 2023. Eligible projects include 11 wastewater projects completed before December 31, 2019, but held back from receiving state aid grant monies appropriated in the current budget biennium, plus 110 new projects identified as eligible for funding in 2022-2023. Note: This is unrelated to the House action eliminating the $15.6 included in the governor’s budget for state aid grant payments for previously approved projects reported in the state budget article above. We are, of course, very hopeful the Senate will restore this critical statutory funding.

- SB 72, the “taxpayer rescue act of 2021,” requires the state to pay 15 percent of employer retirement contributions for teachers, police, and firefighters. The bill is an opportunity to honor a promise that was broken when the state eliminated its long-standing 35 percent contribution in 2013. As a result of that action, political subdivisions have paid more than $729 million dollars in additional employer costs—costs that will increase 20 percent effective July 1, 2021, with the newest rate increase.

Actions to restore state aid and revenue sharing, which these bills represent, are an opportunity to begin to relieve the property tax burden that has been subtly downshifted to the local level as these statutory aid programs were decreased and eliminated—and never restored to the pre-2010 levels, even after the state fully recovered from the 2008-09 recession. Please send your testimony to the Senate Finance Committee explaining how your town or city and its taxpayers can benefit by the restoration of this state aid and revenue sharing.

Municipal State Aid and Revenue Sharing – History & Trends

To assist municipalities and their elected officials as you review the municipal funding in the current state budget, we have included a link here to NHMA’s publication “Municipal State Aid and Revenue Sharing – History & Trends”. In applying the loss and/or reduction of state aid to your individual municipality, the following are offered as tools.

- Revenue Sharing–Distribution Amounts for Each Municipality (see page 7 of above publication). This was the last year that revenue sharing was distributed to municipalities before it was suspended in 2010 due to the economic impact of the recession. Unfortunately, when the economy and state revenues recovered, this revenue sharing was not restored, and suspension of the statute is still included in the current HB 2, Section 40.

- Meals & Rooms Tax Calculation Tool (see page 5 of above publication). SB 99 would restore the statutory 40 percent distribution amount for municipalities.

Non-Germane Amendments Affect Retirement Costs

In unexpected action Wednesday, the Senate Executive Departments and Administration Committee voted 4-1 to recommend Ought to Pass on HB 141, which would allow counties (in addition to municipalities, already allowed) to exempt their chief administrative officers from compulsory participation in the state retirement system. Of concern, the bill requires any county or municipality choosing this option to pay into the retirement system an annual employer contribution equal to the unfunded accrued liability rate for that “exempt” position. As an example, if a chief administrative officer’s salary is $110,000, the full employer contribution rate would be $15,466; the unfunded accrued liability amount required to be paid for the “exempt” position would be $12,287—nearly removing any incentive to the municipality or county to exempt this position. The full Senate will act on this bill at its next session on Thursday, May 6.

As history, the original HB 141 related to maintaining a public registry of fire suppressant usage. The first non-germane amendment replaced the entire bill with a new bill to allow counties to exempt their chief administrative officers from compulsory participation in the New Hampshire Retirement System. The sponsor explained the purpose was to allow a specific county to promote its corrections superintendent to chief administrative officer without the employee having to become a Group I retirement system member, forfeiting his/her previous 30+ years as a Group II member. The House committee subsequently approved a second non-germane amendment adding the requirement that counties and municipalities make annual employer retirement contributions for any such “exempt employees.”

NHMA opposed the second non-germane amendment because it would create new costs for any municipalities that exercise this choice in the future. Further, the bill makes an unprecedented requirement of certain employers to make contributions (81.2% of the total pension costs) for exempt employees. The additional costs effectively eliminate any financial, business-type incentive for a municipality (or county) to attract chief administrative officers from other organizations or states who may already be participating in a non-NHRS plan. Moreover, the additional costs come at the same time the overall employer contribution rates are set to increase approximately 20 percent effective July 1, 2022.

As a result of some confusion about the positions of NHMA and the Association of Counties (NHAC), the committee voted 4-1 to recommend Ought to Pass on the bill as amended. Both NHMA and NHAC oppose Section 2 of the bill, which imposes the new contribution requirement. NHMA is hopeful that a floor amendment will be offered to remove Section 2 of the bill so that counties will be able to exempt their chief administrative officers without new retirement costs being created for counties and municipalities that opt for this exemption.

Members are urged to contact their senators and request that they oppose the bill unless a floor amendment is offered to remove Section 2 of HB 141.

Senate Action on House Bills

The Senate is making good progress on disposing of some of the troubling bills that made it through the House.

Non-disparagement clauses. Yesterday the Senate voted unanimously to kill HB 83, which would have prohibited the inclusion of a non-disparagement clause in any settlement agreement involving a municipality, school district, or other governmental entity. We opposed the bill because it would inhibit settlement of litigation, leading to increased legal expenses, and because there are many situations in which a municipality is already prohibited from discussing details of a lawsuit. Disallowing a clause that would impose a similar prohibition on the other party is unfair.

The House had passed an identical bill in 2019, and the Senate killed it on a voice vote. This year the House Judiciary Committee recommended HB 83 by a 20-1 vote, and it passed the House on the consent calendar. The Senate Judiciary Committee, consistent with its action two years ago, recommended killing the bill by a 4-1 vote; and the Senate voted unanimously to kill it.

Thank you to members of the Senate Judiciary Committee, and all senators, for voting to preserve local control over settlement agreements.

Adoption of SB 2. The Senate Election Law and Municipal Affairs Committee voted unanimously this week to recommend killing HB 374, which would change the process for considering the adoption of the official ballot referendum (SB 2) form of town meeting. We have opposed this bill and have reported on it several times before. We believe that a fundamental change to the town meeting form of government is something that should be decided after a thorough and informed discussion among those voting. That is how it is done under current law, which provides that the vote is to take place at the town meeting’s business session; HB 374 would change that and require that it be voted on by official ballot.

We support the committee’s recommendation of Inexpedient to Legislate. The bill is on the consent calendar for the Senate’s session next week.

Amending petitioned warrant articles. The same committee voted unanimously to recommend killing HB 67, which would prohibit the amendment of a petitioned warrant article in an SB 2 town to “change its specific intent.” We also have opposed this bill and reported on it several times. The bill violates a basic principle of the legislative process, which is that once an article (or a bill) is submitted, it is subject to amendment by the legislative body. There is no reason for petitioned articles, whether in SB 2 towns or elsewhere, to be treated differently. If the petitioners do not want their article to be amended, they need to muster the votes to prevent it.

HB 67 is also on the consent calendar for next week’s Senate session, and again, we support the committee’s recommendation of Inexpedient to Legislate.

Lemonade stands. The committee was not as united when it came to HB 183, the bill that would prohibit a municipality from licensing or regulating a lemonade stand—or, as amended by the House, a soft drink stand—operated by a person under the age of 18. An amendment offered in the committee would have made the bill less objectionable, but the amendment failed on a 2-3 vote, and the bill without amendment failed on the same 2-3 vote. The committee then voted the bill Inexpedient to Legislate, 4-1.

Because the vote was not unanimous, the bill is on the Senate’s regular calendar for next week. We would be happy to see the Senate support the committee recommendation of Inexpedient to Legislate.

Electronic Records Bill

On Wednesday the Senate Executive Departments & Administration Committee voted 4-0 to recommend Ought to Pass on HB 302. This bill, which NHMA supports, clarifies an ambiguity in the law and ensures that political subdivisions may use electronic records and signatures. Many municipalities have been moving toward an electronic—or even fully paperless—environment over the past several years to save money and increase efficiency, and the pandemic brought this issue front and center. This bill will go to the full Senate at its next session on May 6.

New Law Allows Quarterly or Semi-Annual Tax Adjustments

On March 23 the governor signed HB 383, permitting municipalities with semi-annual or quarterly billing to request an adjusted tax rate when a change of 15 percent or more in annual property taxes is anticipated. NHMA supported this bill, which will allow any municipality affected by either (1) a change in adequate education grants or excess tax amounts, or (2) a change of 15 percent or more in the amount of all property taxes to be raised for the current year as compared to the previous year, to apply to the Department of Revenue Administration to adjust the “ ½ of the previous year’s tax rate” by an amount sufficient to collect ½ of the estimated increase or decrease in the city or town, school, or county taxes resulting from the change. The new act, 2021 N.H. Laws Chapter 15, takes effect April 1, 2022.

House Calendar

All hearings will be held remotely. See the House calendar for links to join each hearing. | |

|

|

TUESDAY, MAY 4, 2021 | |

|

|

JUDICIARY | |

9:00 a.m. | SB 95-FN, adopting omnibus legislation relative to access to remote meetings, penalties for violation of privacy, and establishing a committee to study remote meetings. |

9:30 a.m. | SB 126-FN, adopting omnibus legislation on landlord tenant proceedings. |

|

|

WEDNESDAY, MAY 5, 2021 | |

| |

PUBLIC WORKS AND HIGHWAYS | |

10:15 a.m. | Public Hearing on non-germane amendment #2021-1112h to SB 28, naming a courtroom in the second circuit courthouse in Plymouth in honor of Judge Edwin W. Kelly. This amendment names a roundabout in the town of New London in honor of Jessie Levine. Copies of this amendment are available in the Sergeant-at-Arms office, Room 318, State House, or on the General Court website. |

1:15 p.m. | SB 26, relative to roads within the Woodsville Fire District |

|

|

MONDAY, MAY 10, 2021 | |

|

|

FINANCE | |

10:50 a.m. | SB 85-FN, establishing a broadband matching grant initiative and fund. |

11:40 a.m. | SB 152-FN-A, relative to affordable housing program funding. |

|

|

MUNICIPAL AND COUNTY GOVERNMENT | |

9:00 a.m. | SB 84, relative to village district public bodies. |

9:45 a.m. | SB 86-FN, adopting omnibus legislation relative to planning and zoning. |

10:45 a.m. | SB 88, adopting omnibus legislation relative to broadband. |

|

|

TUESDAY, MAY 11, 2021 | |

|

|

JUDICIARY | |

9:00 a.m. | SB 96-FN-A, (New Title) relative to implicit bias training for judges; establishing a body-worn and in-car camera fund and making an appropriation therefor; amending juvenile delinquency proceedings and transfers to superior court; and establishing committees to study the role and scope of authority of school resource officers and the collection of race and ethnicity data on state identification cards. |

|

|

LEGISLATIVE ADMINISTRATION | |

9:00 a.m. | SB 100, adopting omnibus legislation on commissions and committees. |

10:00 a.m. | SB 142-FN, adopting omnibus legislation relative to certain study commissions. |

Senate Calendar

All hearings will be held remotely. See the Senate calendar for links to join each hearing. | |

|

|

MONDAY, MAY 3, 2021 | |

|

|

ELECTION LAW AND MUNICIPAL AFFAIRS | |

9:00 a.m. | HB 77, requiring town and city clerks to provide daily notification to the secretary of state of any filings for elected office. |

9:15 a.m. | HB 98, relative to the date of the state primary election. |

9:50 a.m. | HB 523-FN, requiring a person who registers to vote without any identification to have his or her photo taken before his or her registration to vote is complete. |

|

|

ENERGY AND NATURAL RESOURCES | |

1:00 p.m. | HB 235, addressing impacts to other water users from new sources of water for community water systems. |

1:15 p.m. | Hearing on proposed Amendment #2021-1218s, relative to the PFAS fund and programs, to HB 235, addressing impacts to other water users from new sources of water for community water systems. |

1:30 p.m. | HB 271, relative to standards for per and polyfluoroalkyl substances (PFAS) in drinking water and ambient groundwater. |

1:45 p.m. | HB 135, requiring parties responsible for pollution of a drinking water supply to be financially responsible for certain consequences of that pollution. |

|

|

TUESDAY, MAY 4, 2021 | |

|

|

FINANCE | |

1:00 p.m. | HB 1-A, making appropriations for the expenses of certain departments of the state for fiscal years ending June 30, 2022 and June 30, 2023. HB 2-FN-A-L, relative to state fees, funds, revenues, and expenditures. |

6:00 p.m. | HB 1-A, making appropriations for the expenses of certain departments of the state for fiscal years ending June 30, 2022 and June 30, 2023. HB 2-FN-A-L, relative to state fees, funds, revenues, and expenditures. |

Senate Floor Action

Thursday, April 29, 2021

HB 72, relative to ratification of amendments to the state building code and state fire code. Re-referred.

HB 83, prohibiting non-disparagement clauses in settlement agreements involving a governmental unit. Inexpedient to Legislate.

HB 157, relative to the state health improvement plan and the state health assessment and state health improvement plan advisory council. Passed.

HB 331-FN, relative to a forfeiture of personal property. Inexpedient to Legislate.

HB 397, relative to permitting fees under the shoreland protection act. Passed with Amendment.

HB 471, relative to police disciplinary hearings. Passed with Amendment.

HB 630, authorizing certain procedures for rulemaking. Passed.

NHMA Upcoming Member Events

Weekly | Friday Membership call (1:00 – 2:00) |

May 19 | Webinar: Intersect: New Traffic Technology (12:00 – 1:00) |

May 20 | Code Enforcement (9:00 – 12:00) |

Please visit www.nhmunicipal.org for the most up-to-date information regarding our upcoming virtual events. Click on the Events and Training tab to view the calendar. For more information, please call NHMA’s Workshop registration line: (603) 230-3350. | |