2021 NHMA Legislative Bulletin 15

Primary tabs

LEGISLATIVE BULLETIN

House Passes State Biennial Budget

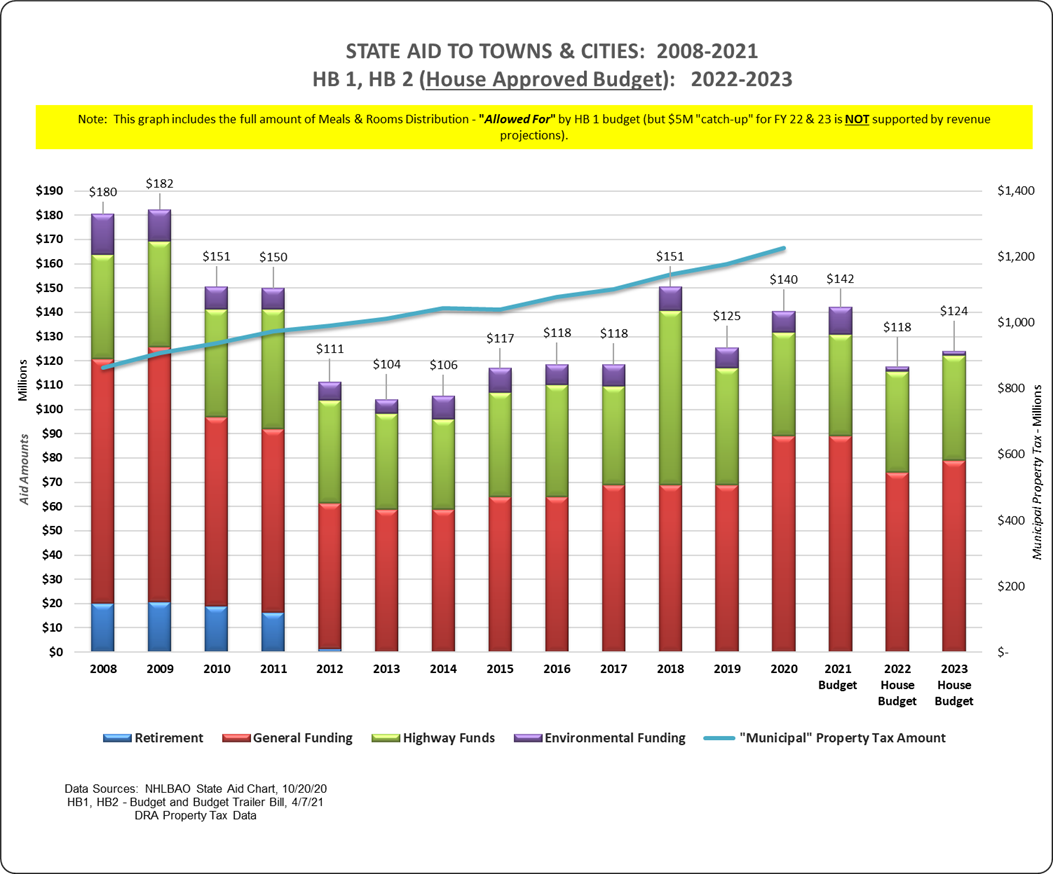

On Thursday, almost completely along party lines, the House passed HB 1 and HB 2, the biennial state operating budget and associated trailer bill for fiscal years 2022 and 2023. The budget represents a reduction of $40.9 million in municipal aid and revenue sharing compared to the current biennium. A floor amendment (1093h) to restore $15.6 million included in the Governor’s budget for statutorily-required state aid grant payments (SAGs) for 162 previously approved water pollution control infrastructure projects was defeated by a roll call vote of 187 to 196. In comments before the House, the minority leader expressed concern that by passage of HB 2 as amended, the House was eliminating $15(.6) million to towns and cities for promised payments for water and wastewater infrastructure. We concur: these payments are statutory (RSA 486) and contractual obligations of the state which, in all cases, were individually acted upon and approved by the governor and executive council over past years.

Municipal aid and revenue sharing included in the budget bills:

- Meals and rooms tax (RSA 78-A:26): $68.8 million guaranteed each year (the same amount since 2017) with an allowance for an up to $15 million increase, based on the catch-up formula (not suspended in this budget for the first time since 2017) if revenues increase sufficiently. Unfortunately, current revenue projections do not support any increase in fiscal year 2022, and support only a $5 million increase in fiscal year 2023—the remaining $10 million would lapse.

- Highway block grant (RSA 235:23): $35.7 million and $37.2 million for fiscal years 2022 and 2023 respectively (approximately equivalent to the current biennium funding). This includes a $2 million additional appropriation for fiscal years 2022 and 2023 to supplement the projected statutory decreased distribution, which is tied to the projected decrease in road toll/gas tax highway revenue.

- Municipal bridge aid (RSA 234, 260:32-b): $6.0 million (a reduction of $1.6 million from the current biennium for this budget line item). Although the Finance Committee reported the statutory $6.8 million is fully funded, NHMA has learned that the $1.6 million, which was deducted from the budgeted line item for municipal bridge aid was, instead, included in a “consultant” expense line item totaling $2,500,000—the first time this budgeting practice has occurred, to our knowledge.

Municipal aid and revenue sharing not included in the budget bills:

- State Aid Grants (RSA 486): $0 for the annual principal and interest payments required for 162 previously-approved projects for water pollution control (see above).

- State Aid Grants (RSA 486, 486-A, 149-M): $0 for SAGs for new projects that have been substantially completed and eligible for funding in fiscal years 2022 and 2023. Moratorium remains on all projects completed after December 2019.

- Revenue Sharing (RSA 31-A): $0 revenue sharing, which has been suspended since 2010; the suspension is again included in HB 2.

- Municipal Aid (Ch 346:172, 2019): $0 to replace this one-time $40 million municipal aid included in the current biennium budget.

In addition to the suspension of the statutory $15.6 million SAG payments for approved projects, the budget also does not include $12.6 million to fund 131 new wastewater projects addressed in HB 398 or $1 million to fund 15 new public water system projects addressed in HB 412; instead, it continues the moratorium on funding any new projects completed after December 2019. We are hopeful the Senate will address the funding issues associated with all of these critical projects to honor the state’s partnership with its political subdivisions to protect the health of its residents and promote the state’s and municipalities’ economic growth.

In Bulletin#14 we noted that HB 2 lowers the statewide education property tax (SWEPT) by $100 million for fiscal year 2023 only. This one-time state “property tax saving” would be funded, instead, by other state revenue sources. The bill further requires that any municipality whose total education grant is decreased due to the SWEPT reduction would receive a supplemental education payment from the state’s education trust fund to satisfy the state’s obligation under RSA 198:41.

The budget includes numerous revenue reductions through various other tax cuts, which include lowering the meals and rooms tax rate to 8.5%, lowering the business enterprise tax rate to 0.55% while also increasing the filing threshold, lowering the business profits tax rate to 7.6%, and fully phasing out the interest and dividends tax over five years.

The budget now goes to the Senate; and the Senate Finance Committee is scheduled to begin its budget review on Monday, April 12. We remind you that there are four state aid-related bills on the Senate table, which will be considered during the Senate budget process: SB 99 (meals and rooms tax return to 40% distribution); SB 118 ($40 million municipal aid); SB 72 (15% retirement system employer contribution); and SB 127 ($12.6 million for new, eligible SAG projects). We will continue to provide updated information and public hearing times and dates. In the meantime, we encourage you to contact your senators and the Senate Finance Committee and explain the importance and impact of these important state aid programs on your budgets and local property tax.

House Floor Action: A Few Bright Spots

The House’s three-day session is still in progress as this Bulletin goes to press, and several of the bills of greatest concern remain to be taken up. Here is what has happened so far on some of the bills we are following:

Constitutional Tax Cap. The House failed to pass CACR 9, a constitutional amendment that would impose a two percent cap on all municipal property tax increases. A constitutional amendment requires a three-fifths vote of the entire House membership to pass, which would be 239 votes in the affirmative. The vote did not come close, failing to gain even a simple majority, 175-193.

Non-Disparagement Clauses. HB 83, which prohibits non-disparagement clauses in settlement agreements involving a government entity, was on the consent calendar with an Ought-to-Pass recommendation. It was not removed from the consent calendar, so it has passed the House and is now in the Senate, where it has a hearing before the Judiciary Committee next Wednesday, April 14, at 1:00 p.m. Please consider testifying in opposition to this bill, or contact members of the Judiciary Committee and your own senator.

Gunfire on Town-Owned Lands. On an almost straight party-line vote (thank you to the four Republicans who voted no), the House passed HB 307, which requires municipalities to allow gun sales and the discharge of firearms, without limitation, on town-owned property. No hearing has been scheduled yet in the Senate.

“Divisive Concepts.” The House tabled HB 544, the bill that would require the state and municipalities to violate the First Amendment by telling contractors what they may and may not say to their employees. That seems like a good result on its face, but the only reason the bill was tabled is that the House included the language of HB 544 in HB 2. Fortunately, all indications are that this language will be removed immediately when HB 2 arrives in the Senate.

Collective Bargaining Negotiations. By a vote of 168-187, the House rejected a committee recommendation of Ought to Pass on HB 206, which would have required that collective bargaining negotiations occur at meetings open to the public. The bill was then voted Inexpedient to Legislate.

At press time, there were still several dozen bills awaiting action, and it seemed unlikely that the House would get through them all by the end of the day. Today is the deadline to act on all bills, so if there are bills still awaiting action at the end of the day, one of two things will happen: either those bills die or the House amends the rules to move the deadline to next week.

Among the important bills that had not been acted on by late Friday morning are:

- HB 67, relative to warrant articles in official ballot referendum towns.

- HB 111, relative to governmental liability and immunity.

- HB 243, relative to the form of municipal budgets.

- HB 266, relative to enforcement of immigration laws and the prohibition of sanctuary policies.

- HB 374, relative to the official ballot referendum form of town meetings.

- HB 439, relative to the powers of city councils.

Please check the docket for any bill you are interested in or contact us if you have any questions. We will have an update in next week’s Bulletin.

Senate Passes Net Metering Bill

In all the hullabaloo the last few weeks about the marathon House session, we have not reported much about what is happening in the Senate. One bit of good news is that the Senate unanimously passed SB 109 last week. That bill exempts “municipal hosts” from the one-megawatt cap for a “customer-generator” to participate in net metering. The bill defines a “municipal host” as “a customer generator with a total peak generating capacity of greater than one megawatt and less than 5 megawatts used to offset the electricity requirements of a group consisting exclusively of one or more customers who are political subdivisions, provided that all customers are located within the same utility franchise service territory.”

NHMA has supported broader legislation to raise the cap to five megawatts for all customer-generators, but in the absence of that, we certainly support SB 109, and we know that many municipalities are interested in it. The governor has vetoed net metering expansion bills several times in recent years, but we understand that he is comfortable with SB 109.

After passing the bill, the Senate immediately laid it on the table. Look for the language of SB 109 to turn up as a Senate amendment to a House bill sometime in the next month or so.

Senate Calendar

All hearings will be held remotely. See the Senate calendar for links to join each hearing. | |

|

|

MONDAY, APRIL 12, 2021 | |

|

|

ELECTION LAW AND MUNICIPAL AFFAIRS | |

9:00 a.m. | HB 64-L, relative to renewable generation facility property subject to a voluntary payment in lieu of taxes agreement. |

9:15 a.m. | HB 79, relative to town health officers. |

9:30 a.m. | HB 88, relative to the city of Claremont police commission. |

10:15 a.m. | HB 284, relative to the restoration of involuntarily merged lots. |

|

|

ENERGY AND NATURAL RESOURCES | |

1:45 p.m. | HB 397, relative to permitting fees under the shoreland protection act. |

2:00 p.m. | HB 413, establishing a solid waste working group on solid waste management planning and relative to compost. |

|

|

WAYS AND MEANS | |

9:00 a.m. | HB 154-L, relative to community revitalization tax relief incentives. |

|

|

TUESDAY, APRIL 13, 2021 | |

|

|

JUDICIARY | |

1:00 p.m. | HB 108-FN-L, relative to minutes and decisions in nonpublic sessions under the right-to-know law. |

|

|

WEDNESDAY, APRIL 14, 2021 | |

|

|

JUDICIARY | |

1:00 p.m. | HB 83, prohibiting non-disparagement clauses in settlement agreements involving a governmental unit. |

1:45 p.m. | HB 474, prohibiting surveillance by the state on public ways or sidewalks. |

|

|

THURSDAY, APRIL 15, 2021 | |

|

|

ELECTION LAW AND MUNICIPAL AFFAIRS | |

9:00 a.m. | HB 126, relative to notice of execution of tax lien to mortgagees. |

9:15 a.m. | HB 164, relative to the acquisition, sale, or demolition of municipal land or buildings. |

9:50 a.m. | HB 411, establishing a commission to study the equalization rate used for the calculation of a property tax abatement by the New Hampshire board of tax and land appeals, the superior court, and all cities, towns, and counties. |

10:15 a.m. | HB 486-FN, relative to eligibility for the low and moderate income homeowners property tax relief. |

|

|

JUDICIARY | |

1:00 p.m. | HB 471, relative to police disciplinary hearings. |

2:00 p.m. | HB 286, establishing a committee to study the response of law enforcement and the criminal justice system to homelessness in New Hampshire. |

House Floor Action

Wednesday, April 7, 2021 to Friday, April 9, 2021

CACR 3, relative to use of money raised by taxation for education. Providing that money raised by taxation may be applied for the use of religious educational institutions. Failed, lacking necessary 3/5 majority.

CACR 9, relative to municipal taxes. Providing that municipalities may not raise property taxes by more than 2 percent per year. Failed, lacking necessary 3/5 majority.

HB 1-A, making appropriations for the expenses of certain departments of the state for fiscal years ending June 30, 2022 and June 30, 2023. Passed with Amendment.

HB 2-FN-A-LOCAL, relative to state fees, funds, revenues, and expenditures. Passed with Amendment.

HB 25-A, making appropriations for capital improvements. Passed with Amendment.

HB 64-LOCAL, relative to renewable generation facility property subject to a voluntary payment in lieu of taxes agreement. Passed.

HB 72, relative to ratification of amendments to the state building code and state fire code. Passed with Amendment.

HB 77, requiring town and city clerks to provide daily notification to the secretary of state of any filings for elected office. Passed with Amendment.

HB 79, relative to town health officers. Passed.

HB 83, prohibiting non-disparagement clauses in settlement agreements involving a governmental unit. Passed with Amendment.

HB 88, relative to the city of Claremont police commission. Passed.

HB 98, relative to the date of the state primary election. Passed with Amendment.

HB 108-FN-LOCAL, relative to minutes and decisions in nonpublic sessions under the right-to-know law. Passed.

HB 125, relative to post-arrest photo distribution by law enforcement officers. Passed with Amendment.

HB 126, relative to notice of execution of tax lien to mortgagees. Passed.

HB 135, requiring parties responsible for pollution of a drinking water supply to be financially responsible for certain consequences of that pollution. Passed with Amendment.

HB 141-FN, requiring the department of environmental services to maintain a public registry of where certain fire suppressants have been used. Passed with Amendment.

HB 151, relative to changes of registration of certain voters after a primary election. Inexpedient to Legislate.

HB 154-LOCAL, relative to community revitalization tax relief incentives. Passed.

HB 157-FN, repealing the state health assessment and state health improvement plan council. Passed with Amendment.

HB 164, relative to the acquisition, sale, or demolition of municipal land or buildings. Passed.

HB 206, relative to collective bargaining agreement strategy discussions under the right-to-know law. Inexpedient to Legislate.

HB 217, repealing RSA 320 regarding hawkers and peddlers. Inexpedient to Legislate.

HB 218, repealing RSA 321 regarding itinerant vendors. Passed with Amendment.

HB 225, relative to the calculation of net energy metering payments or credits. Inexpedient to Legislate.

HB 232, relative to nonpublic sessions under the right to know law. Passed.

HB 235, relative to community small groundwater withdrawal. Passed with Amendment.

HB 236, creating a statute of limitation on civil actions relative to damage caused by perfluoroalkyl and polyfluoroalkyl substances. Passed.

HB 262, relative to the adoption of bylaws and ordinances by municipalities. Inexpedient to Legislate.

HB 271, relative to standards for per and polyfluoroalkyl substances (PFAS) in drinking water and ambient groundwater. Passed with Amendment.

HB 284, relative to the restoration of involuntarily merged lots. Passed with Amendment.

HB 285, relative to verification of voter checklists. Passed.

HB 286, establishing a committee to study the response of law enforcement and the criminal justice system to homelessness in New Hampshire. Passed.

HB 291, relative to public inspection of absentee ballot lists. Passed.

HB 292, relative to the absentee ballot application process. Passed.

HB 295, relative to initiating amendments and corrections to birth records. Laid on Table.

HB 307, relative to the state preemption of the regulation of firearms and ammunition. Passed with Amendment.

HB 326, requiring town and city clerks to make electronic lists of persons who have requested, been mailed, or returned absentee ballots available to candidates upon request. Passed.

HB 348, requiring a public employer to provide notice of a new or amended collective bargaining agreement. Laid on Table.

HB 385-FN, relative to workers’ compensation for heart and lung disease in firefighters. Passed with Amendment.

HB 395-FN, relative to consideration of home-share income and exempting rentals of shared facilities from requirements under the real estate practice act. Inexpedient to Legislate.

HB 397, relative to permitting fees under the shoreland protection act. Passed with Amendment.

HB 411, establishing a commission to study the equalization rate used for the calculation of a property tax abatement by the New Hampshire board of tax and land appeals, the superior court, and all cities, towns, and counties. Passed.

HB 413, establishing a solid waste working group on solid waste management planning and relative to compost. Passed with Amendment.

HB 415, relative to municipal estimates of expenditures and revenues. Inexpedient to Legislate.

HB 419-FN, relative to assault of a campaign worker at the polling place. Inexpedient to Legislate.

HB 448, establishing a committee to study and compare federal Occupational Safety and Health Act standards with the safety and health standards the New Hampshire department of labor uses for public sector employees. Passed.

HB 454, relative to the requirement that certain governing bodies submit recommendations to the budget committee. Inexpedient to Legislate.

HB 463, requiring the Gorham town clerk to be appointed by the board of selectmen. Inexpedient to Legislate.

HB 467, relative to current use tax rate eligibility. Inexpedient to Legislate.

HB 471, relative to police disciplinary hearings. Passed with Amendment.

HB 474, prohibiting surveillance by the state on public ways or sidewalks. Passed with Amendment.

HB 476, relative to election officers at additional polling places. Passed.

HB 486-FN, relative to eligibility for the low and moderate income homeowners property tax relief. Passed.

HB 499, prohibiting the state from using a face recognition system. Passed with Amendment.

HB 523-FN, requiring a person who registers to vote without any identification to have his or her photo taken before his or her registration to vote is complete. Passed.

HB 534, relative to municipal control of certain frozen water bodies. Inexpedient to Legislate.

HB 544, relative to the propagation of divisive concepts. Laid on Table.

HB 545, relative to the use of certain out-of-state banks by the state treasurer and municipal and county treasurers or trustees. Passed.

HB 552, relative to property tax valuations. Inexpedient to Legislate.

HB 555, relative to prisoners’ voting rights. Passed.

HB 566, relative to sealing records in nonpublic session under the right-to-know law. Passed with Amendment.

HB 573, relative to the uses of certain large retail properties. Inexpedient to Legislate.

HB 574, relative to change of use of certain retail properties. Inexpedient to Legislate.

HB 630, relative to remote board meetings under the right-to-know law and authorizing certain procedures for rulemaking. Passed with Amendment.

Senate Floor Action

Thursday, April 8, 2021

HB 73, relative to public notice requirements for certain permits issued by the department of environmental services. Passed.

HB 110, relative to the distribution of adequate education grants. Re-referred.

HB 256, adding members from Londonderry to the commission to investigate and analyze the environmental and public health impacts relating to releases of perfluorinated chemicals into the air, soil, and groundwater in Merrimack, Bedford, and Litchfield. Passed.

HB 356, relative to the city of Manchester employees’ contributory retirement system. Passed.

HB 377, relative to the authority of the state fire marshal to grant an exemption from fire code requirements to recovery houses. Passed.

NHMA UPCOMING MEMBER EVENTS

Weekly | Friday Membership call (1:00 – 2:00) |

Apr. 13 | Webinar: ZBA Basics (12:00 – 2:00) |

Apr. 15 | Right-to-Know Law: Public Meetings & Governmental Records (1:30 – 3:30) |

Apr. 16 | Membership Call including 2021 Legislative Half-Time Report (1:00 – 2:00) |

Apr. 22 | Recycling 101: Municipal Solid Waste & Recycling in NH (9:00 – 12:00) |

May 6 | A Hard Road to Travel (9:00 – 12:30) |

Please visit www.nhmunicipal.org for the most up-to-date information regarding our upcoming virtual events. Click on the Events and Training tab to view the calendar. For more information, please call NHMA’s Workshop registration line: (603) 230-3350. | |